This Act requires the State to reimburse healthcare expenses incurred by eligible pensioner spouses on Medicare who are required to enroll in their former employer’s healthcare coverage and their former employer’s coverage pays less than the State’s coverage would pay. This creates fair and equal benefit coverage for all spouses of eligible pensioner’s whether they have former employer coverage or not

House Bill 248

Legislative Highlights

House Bill 109

From the 153rd General Assembly, this Act amends Title 9 to update Delaware’s property reassessment schedule by requiring each county to reassess real property values at least once every 10 years. This change replaces the previous 5-year mandate and aims […]

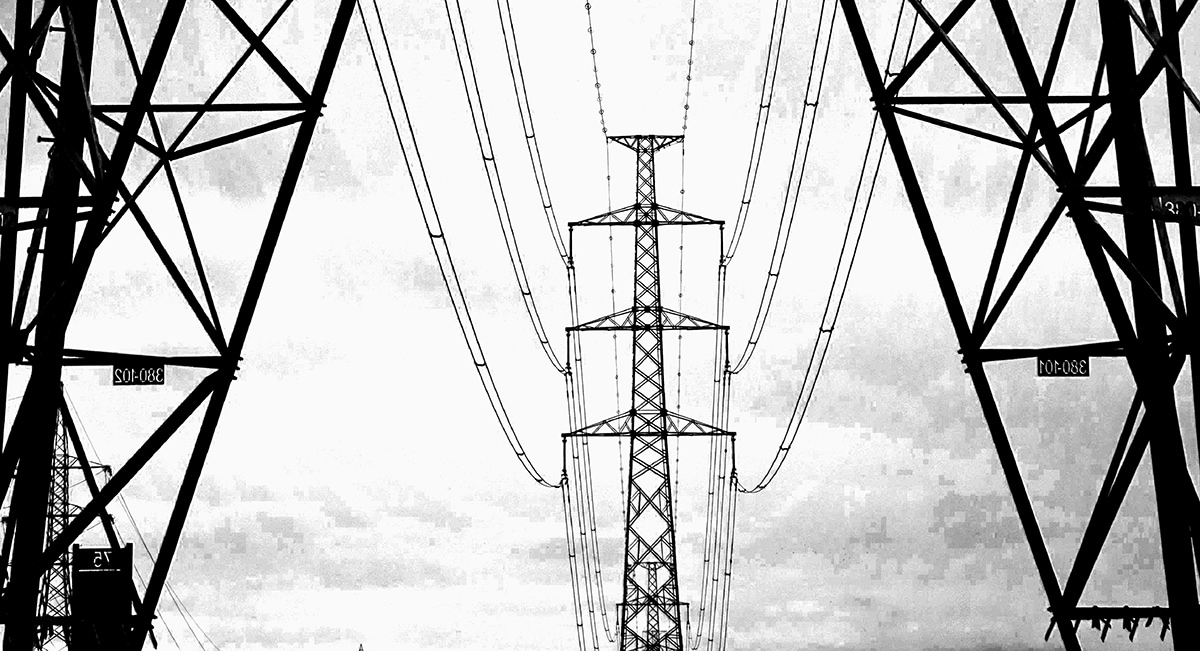

House Bill 186

From the 153rd General Assembly, this Act amends Title 30 to create a state Electricity Production Tax Credit (EPTC) to incentivize the construction and operation of up to three high-efficiency Combined-Cycle Gas Turbine (CCGT) facilities in Delaware. Eligible facilities must […]

House Bill 29

From the 152nd General Assembly, this Act increases the Senior Real Property Tax credit to $750 from $400 as authorized in the Appropriations Bill for fiscal year ending June 30, 2023, which effectively amended Title 29, § 6102(q)(3) from $500 […]

Senate Bill 111

From the 153rd General Assembly, this Act updates the Charter of the Town of Odessa to authorize the use of Title 9, Chapter 87 of the Delaware Code for collecting unpaid taxes and fees. This includes the monition method of […]