For Immediate Release: October 30, 2025

For More Information: Joseph Fulgham, 302-744-4184

In the wake of today’s Delaware Chancery Court decision upholding a proposed two-tier system of property taxation, two Delaware State Representatives are calling for New Castle County to repeat its property reassessment process, maintaining the previous evaluations and tax rates in the interim.

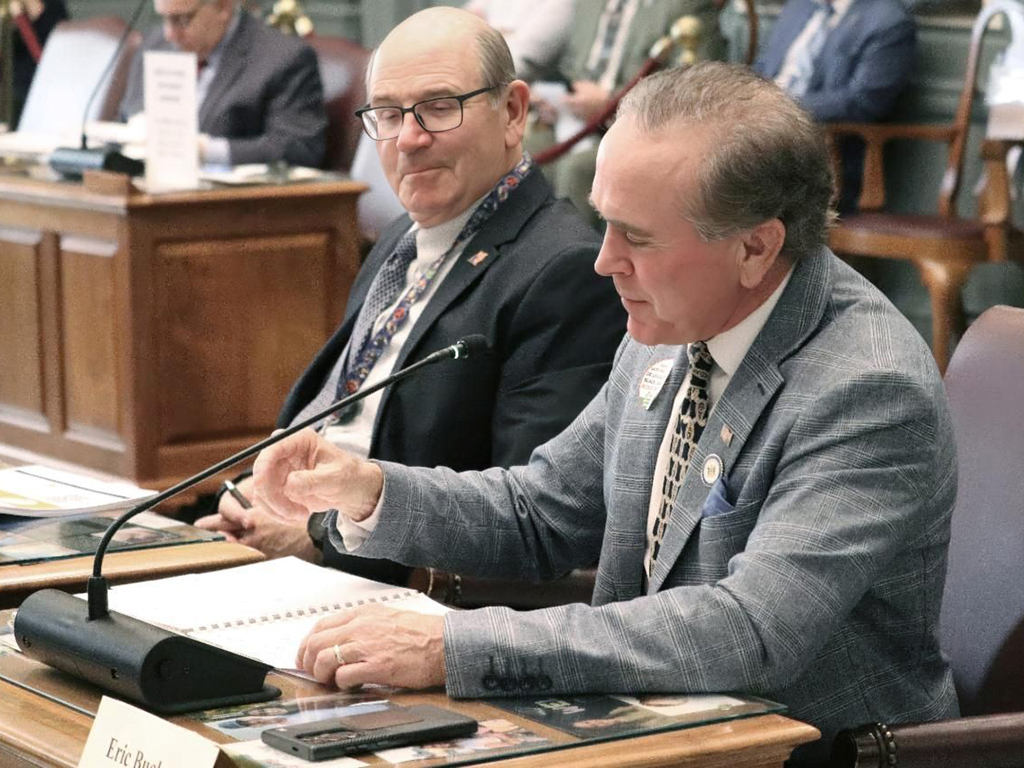

State Reps. Kevin Hensley (Townsend, Odessa, Port Penn) and Mike Smith (R-Pike Creek Valley) say the best path forward is for New Castle County to take a “mulligan” and repeat the process. Both legislators sit on the House Special Property Reassessment Committee and have been taking part in a joint investigation of the county’s flawed outcome.

“Regardless of whether we have a one-tier or two-tier system of tax rates is kind of beside the point,” Rep. Hensley said. “The property valuations on which those taxes are based are badly flawed. For instance, at the first committee meeting, we learned that there was no differentiation between preserved farmland and farmland not in the preservation program, even though there is a huge difference between the two.”

Rep. Smith agreed that New Castle County residents have no trust in what’s been produced. “Even under the standards used by Tyler Technologies, we know that many commercial properties were severely undervalued. Some properties vanished during the process or had major components that were left unassessed. Even if we have an extended and thorough appeals process, that would only potentially correct overvalued assets. No one who owns undervalued properties will be appealing those decisions. Leaving the owners of commercial properties to pay less than their fair share means homeowners will collectively pay more. No one should find that acceptable.”

State House Minority Whip Jeff Spiegelman (R-Townsend, Smyrna, Clayton), who works in the commercial real estate industry, echoed the thoughts of his caucus members. “Taxation, like any government institution, is based on public faith. I’ve seen some of the commercial property valuations produced by this process and, even having insight into the market that most people lack, I can’t make the numbers work. The fact the legislature took the extraordinary step of meeting in a special session and is now conducting a joint probe of what went wrong emphasizes what we all already know: The public has no confidence that the reassessment was done well or fairly.”

All three legislators note the county’s 2024 reassessment resulted from the settlement of a 2020 lawsuit filed by a coalition of groups. The plaintiffs successfully claimed that the lack of contemporary valuations had created disparities in public education funding. Prior to the legal action, New Castle County last conducted an assessment in 1983. Delaware’s other two counties, which were also sued and entered into separate settlements, had also not reassessed in decades.

“This reassessment was only done to address the unequal property tax burdens placed on homeowners and business owners,” Rep. Hensley said. “I would argue that the county’s latest efforts have done nothing to correct the situation. It’s just produced a different pattern of inequities.”

Rep. Smith said there is only one acceptable remedy. “We need to toss the most recent reassessment, continue the investigation, learn from the mistakes that were made, observe the best practices employed by Kent and Sussex counties, and redo this thing. In the meantime, use the old valuations and tax rates.”

Both Reps. Hensley and Smith said they would work across the aisle with other members of the House and Senate Special Property Reassessment Committees to make their proposal a reality, including the potential for the state to finance a portion of the work.