Thousands of owners of certain hybrid vehicles were incorrectly informed that a new “Alternative Fuel Vehicle” (AFV) fee, implemented on October 1st, applied to them.

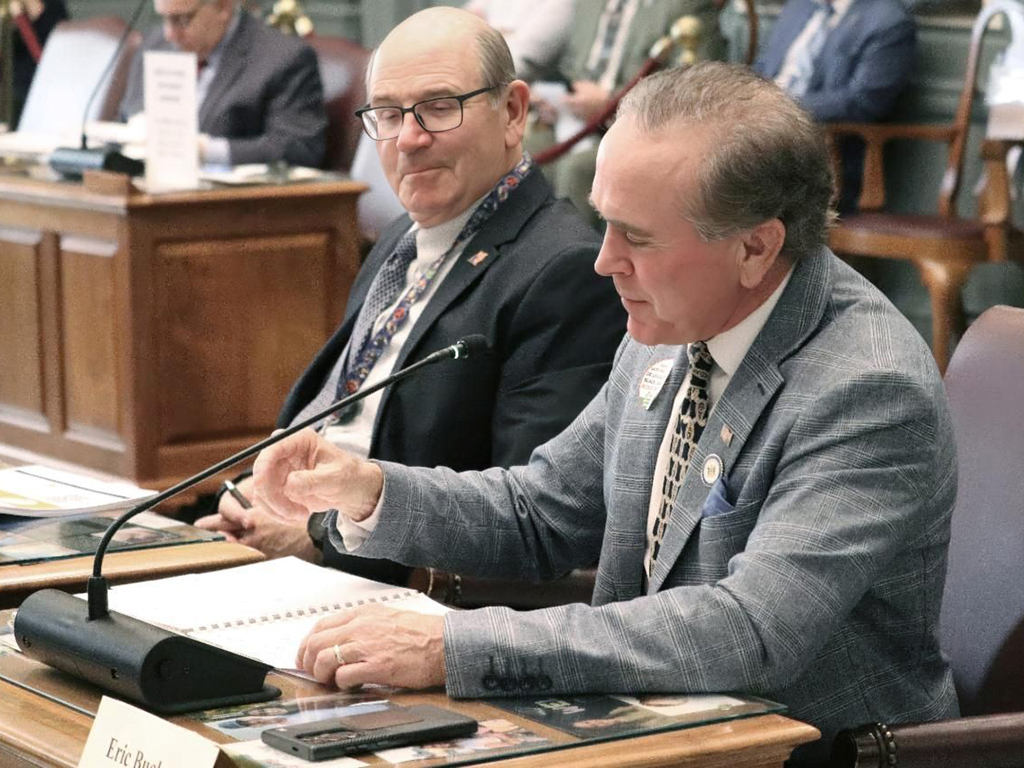

The new levy resulted from the enactment of a contested piece of legislation requested by the Delaware Department of Transportation (DelDOT) that raised many existing vehicle fees and created new ones.

The Alternative Fuel Vehicle fee was intended to capture the owners of vehicles not solely powered by gasoline or diesel. For decades, the state and federal governments have imposed taxes on these commodities, the revenue from which is a major source of funding for road maintenance and construction. The people using vehicles not powered by traditional fuels have avoided paying this support.

However, in an email sent to lawmakers this week, Transportation Secretary Shante Hastings said a mistake was made when the owners of “mild hybrid” vehicles were told they owed the fee.

According to the U.S. Department of Energy, mild hybrids—also called micro hybrids—use a battery and electric motor in a system that allows the engine to shut off when the vehicle stops (such as at traffic lights or in stop-and-go traffic), improving fuel economy. Mild hybrid systems cannot power the vehicle using electricity alone.

“Unfortunately, these vehicles were initially categorized as non–plug-in electric vehicles by our vendor within our database,” Sec. Hastings wrote. “We have since corrected the classification and will notify affected vehicle owners that their vehicles are excluded from the Alternative Fuel Vehicle (AFV) fee.”

“Roughly, 8,459 registered vehicles across the state fall into the mild hybrid classification,” said Aimee Voshell String, DelDOT’s Chief of Legislative Relations.

Alternative fuel vehicle owners who have questions or require further assistance can contact the DMV via email DMVCustomerService@delaware.gov or by calling 302-744-2500.