Facts should matter, especially when considering decisions that impact state revenues, spending, the growth of emerging businesses, and Delaware’s desirability as a venue for incorporation.

PREAMBLE

House Bill 255 deals with the impact on Delaware from the federal One Big Beautiful Bill Act (OBBBA), which was signed into law in early July. Our state, like all other states, links portions of its tax laws to the federal code, so decisions made in the nation’s capital can have an impact on Delaware tax collections.

At issue are a few select provisions of the omnibus federal law aimed at encouraging businesses to make investments in research and development, as well as production improvements. The changes gave business owners greater flexibility in claiming deductions for these expenses and made some of these favorable terms retroactive.

The Delaware Division of Revenue maintains that if no action is taken, Delaware would lose a total of $410 million in revenue over the current and next two fiscal years. HB 255 would “decouple” Delaware’s tax code from these aspects of federal law, reportedly reducing the state’s three-year total revenue loss to about $74 million, if enacted immediately.

Needing a minimum of 25 votes to pass in the House yesterday, House Bill 255 garnered 26 “yes” votes, all of which were from members of the House Democratic Caucus. The final tally was 26 “yes,” 13 “no,” and two absent.

The leadership of the Senate chose not to bring their members to Legislative Hall on Thursday, but is expected to convene next week to consider the bill.

The following are among the reasons the members of the House Republican Caucus opposed the measure…

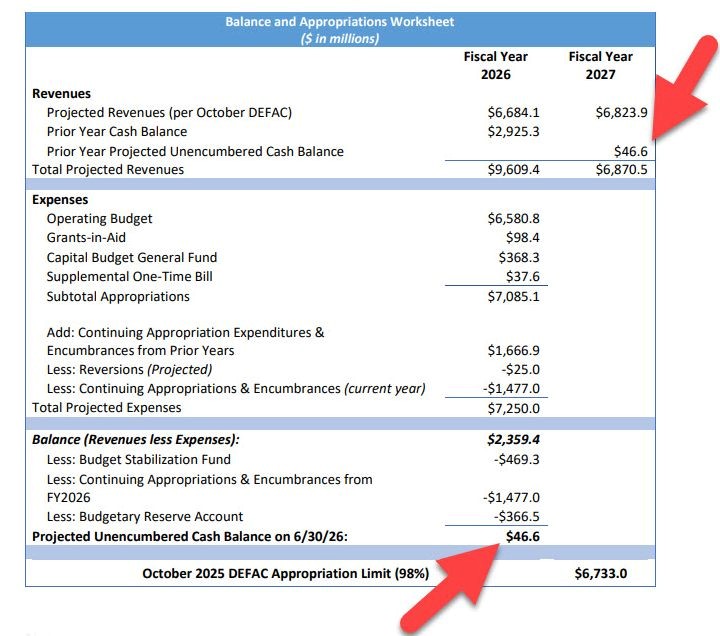

THE NARRATIVE HAS BEEN INTENTIONALLY MISLEADING

- In contrast to the narrative being promoted by the bill’s supporters, maintaining the status quo would not result in a deficit in the current fiscal year. In fact, the state’s latest revenue projections issued less than a month ago show the state ending FY2026 on June 30th with more than $46 million in cash that will be carried over into the next budget. This projection also leaves our budget reserves — the $469.3 million Budget Stabilization Fund (budget smoothing account) and the $366.5 million Budgetary Reserve Account (Rainy Day Fund) — untouched and intact. (See below.)

WHY DELAWARE’S BUSINESS REPUTATION MATTERS

- Less than eight months ago, the Delaware General Assembly enacted legislation to reform Delaware corporate law and restore predictability to the adjudication of cases coming before the Chancery Court. This was a reaction to companies, including SpaceX, Tripadvisor, Dropbox, Andreessen Horowitz, The Trade Desk, Neuralink, and many others, announcing plans to leave Delaware and incorporate elsewhere. The First State’s long-standing status as a destination for incorporations has reaped enormous benefits, with about a third of all state revenue derived from it.

- Delaware is home to more than 2.1 million active business entities, including over 60% of Fortune 500 companies. Delaware Secretary of State Charuni Patibanda-Sanchez testified yesterday in the House that filings are up this year. However, she also maintained that enacting HB 255 would not factor into any corporate leader’s calculations about retaining their presence in the First State.

- A day earlier, on Wednesday (11/12), Coinbase announced that it is relocating its legal corporate home from Delaware to Texas. In broadcast remarks, Coinbase Chief Legal Officer Paul Grewal explained the company’s decision, saying: “After a long experience as a public company incorporated in the State of Delaware, we concluded it was best for us to seek greater predictability, greater fairness in a state like Texas.” To hear the complete remarks, click here.

- Secretary Patibanda-Sanchez is correct when she says Delaware’s incorporation franchise is currently strong. However, she may be being less than candid when she maintains that the enactment of new anti-business policies, and the manner in which they were adopted, will have no impact on the mindset of business leaders if they are not directly affected. The strength of any relationship is constantly assessed by those in it based on many diverse factors. And like any relationship, things are often fine–until they’re not. Meeting in an extraordinary session and changing our House Rules to allow remote voting solely to ensure the passage of a bill that will significantly affect our business tax code will do nothing but confirm that Delaware is becoming a more volatile and unpredictable place to do business. Once trust is lost, it cannot be easily regained.

A FALSE SENSE OF URGENCY

- Delaware law enforcement officials are constantly warning citizens that scammers will create a sense of urgency to prevent them from weighing decisions and forcing them into action. Calling for an extraordinary session on HB 255 is akin to that. There’s a crisis we have to manage now! We can’t wait!

- By law, the state is prohibited from spending more than 98% of its expected revenues. So, the revenue forecasts we produce six times annually determine our state spending limits.

- Consider the first forecast made during the current fiscal year, which was issued last month. While the Meyer administration has said that the state will lose approximately $223 million this fiscal year if we do not pass HB 255 now, the actual revenue prediction for the period dropped by less than half that (about $98 million). To put that figure into context, it is less than 1.5% of our $6.58 billion state budget — well within the 2% buffer we build into our budgeting process specifically to account for such circumstances. State revenue estimates fluctuate up and down every time they are updated.

- Between now and the start of the new fiscal year, which will not begin until July 1, five additional state revenue estimates will be released, including one due on December 15. These continuing estimates will provide budget writers with greater clarity on the adjustments that need to be made. Taking a cautious, measured approach is fiscally prudent, allowing for better-informed choices while avoiding rash actions that could further damage Delaware’s vital standing in the business community.

ANY FUTURE BUDGET CHALLENGES WE FACE ARE MORE ATTRIBUTABLE TO DELAWARE’S PAST SPENDING DECISIONS THAN ANY FEDERAL LAW CHANGE

- If there are financial challenges in our future, they will largely be due to the spending choices made by the same lawmakers who support House Bill 255. Comparing FY 2021 to FY 2025, actual General Fund appropriations jumped by $2.4063 billion, or more than 53.2%. That calculation does not include the expected 5% to 7% increase in the current fiscal year. Our rapid increase in spending, fueled by federal relief dollars, has significantly outpaced our revenue growth, leading to an unsustainable financial situation.

WE SHOULD LISTEN TO THE EXPERTS

Among those expressing opposition to House Bill 255 are the following:

— The Delaware State Chamber of Commerce,

— The New Castle County Chamber of Commerce,

— The Delaware Business Roundtable,

— The Delaware Society of CPAs,

— DelawareBio,

— Former Democratic State Representative Quinn Johnson, a past chair of the committees that drafted the State of Delaware’s operating and capital budgets.

— Former Delaware Secretary of Finance Rick Geisenberger.

- “Delaware has long benefited from a tax system that aligns with federal standards, providing clarity and consistency for businesses and tax professionals alike. HB 255 proposes deviating from this approach by decoupling from key federal provisions related to bonus depreciation and research and development (R&D) expensing. This shift would complicate compliance, increase administrative burdens, and send a discouraging message to companies evaluating Delaware as a place to invest and grow.” — Dana Rubenstein, President/CEO, Delaware Society of CPAs

- “We worry the Bill (House Bill 255) disproportionately harms small and startup science and technology businesses whose existence and immediate growth potential depends upon receiving the immediate benefit of R&D expensing…It is alarming to us that Delaware would stand alone in targeting the very businesses that our Governor, our economic development representatives, financial industry leaders, and entrepreneurs, all believe is part of our state’s long-term future.” — Joint letter signed by Michael Quaranta (President, DE State Chamber of Commerce), Robert Perkins (Executive Director, DE Business Roundtable, and Michael Fleming (President and CEO, Delaware BioScience Association)

- “The depreciation that this legislation (House Bill 255) is attempting to alter was in existence during past budget cycles. We did not decouple then, so why are we attempting to decouple now?…I know firsthand how difficult these decisions are to make. I was JFC and Bond chair during many deficit periods. Please stay with the current fundamentals we have in place now and utilize the current methods of balancing the budget. I can assure you that it is not a matter of if this alternative will cause long-term problems; it’s a matter of when, and it will ultimately come back and hurt the very people you are trying to avoid hurting now.” — Former Democratic State Representative Quinn Johnson, a past chair of both the Bond Bill Committee and Joint Finance Committee

- “[Delaware revenue forecasting officials do] a pretty good job estimating nearly all revenue types, but consistently tend to miss the mark in [their] estimates of Corporate and Business Income Taxes — the State’s most volatile and unpredictable revenue source. Indeed, over the last decade, revenue forecasts of the negative impacts of the Delaware Competes Act (2015), the Delaware Commitment to Innovation Act (2016), and the federal Tax Cut and Jobs Act (2017) were wildly wrong. This is due to numerous factors — including the fact that it is impossible to predict the level of increased economic activity that tends to come from lower taxes and the slower economic activity that tends to come from higher taxes.” — Former Delaware Secretary of Finance Rick Geisenberger