The Delaware Economic & Financial Advisory Council (DEFAC) met earlier this week to update revenue and spending projections for the current and future fiscal years.

The revenue estimates, made periodically throughout the year, dropped significantly in the October report compared with the last estimate made in June.

The forecasts are key to crafting the state’s annual operating budget because officials are mandated to spend no more than 98% of expected incoming funds.

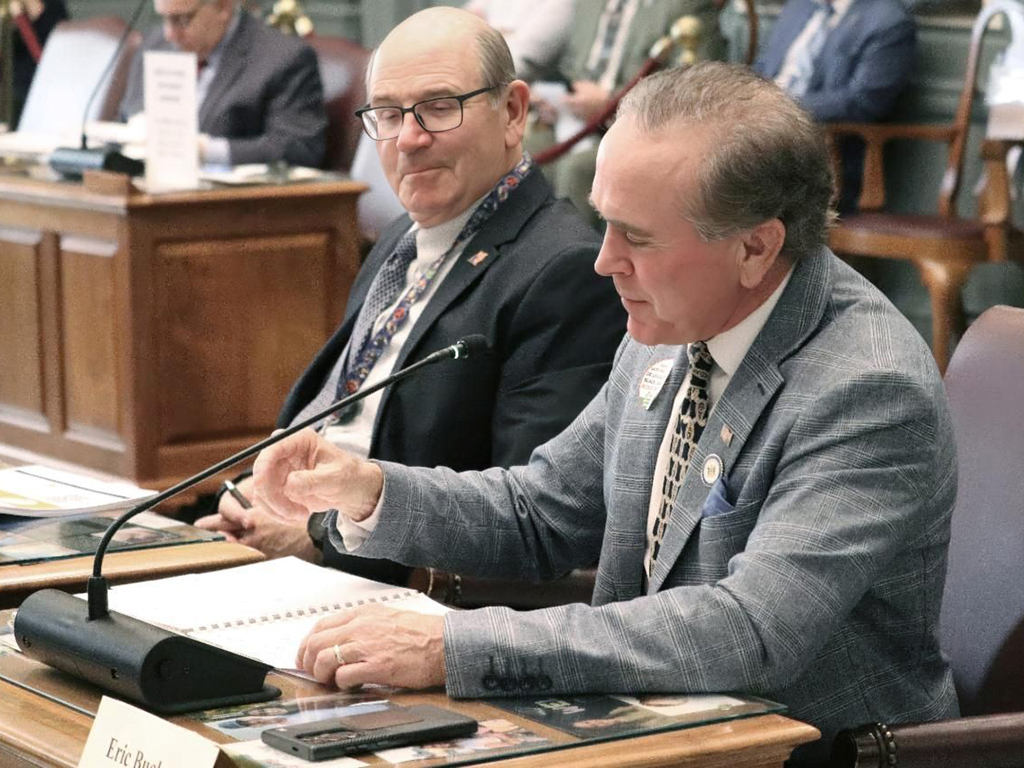

The following is a statement issued by the House Republican Caucus in reaction to the DEFAC report:

Delaware’s revenue projections may be down, but our spending continues to be way up. And, that’s the real problem Delaware faces!

Compared to the June projections, DEFAC reports that state revenues are projected to drop by $150 million for this year and next, largely due to lower corporate income tax collections tied to federal tax changes.

Under these new federal changes, corporations can retroactively adjust past tax filings, going back as far as Tax Year 2022. That means many large companies can now file amended returns and claim refunds from the state on taxes they already paid. This is good for Delaware’s economy because it allows companies to reinvest in their facilities and workforce, encouraging job growth and retention.

Here’s the bigger problem, though: Over the past three years, Delaware’s state budget has grown by $1.48 billion — a 29% increase. Compared to ten years ago, it’s up $2.67 billion — about 68%!

It’s time to have an honest conversation about Delaware’s fiscal responsibility and sustainability.