For Immediate Release:

Friday, March 1, 2024

For More Information, Contact:

Matt Revel: 302-744-4085

Joe Fulgham: 302-744-4184

House and Senate Republican legislators are sponsoring measures to provide financial relief for low and moderate-income Delawareans, create incentives to hire people facing employment challenges, and reduce the tax burden on retired veterans.

Eliminating “Bracket Creep” to Help Low and Moderate-Income Delawareans

Sponsored by State Rep. Rich Collins (R-Millsboro), House Substitute 1 for House Bill 149 would adjust state personal income tax brackets annually to account for cost-of-living increases. The measure would prevent inflationary pay increases from pushing the additional income into a new tax bracket where it would be taxed at a higher rate – a circumstance known as “bracket creep.”

“Cost-of-living pay increases are intended to offset inflation, not create a greater tax burden,” Rep. Collins said. “This proposal is mainly aimed at Delawareans earning modest wages. How does it help working families when their employers give them a cost-of-living raise, and the state responds by reaching deeper into their pockets?”

Upon enactment, the proposal would recalculate personal income tax brackets annually based on the change in the Consumer Price Index for the last fiscal year. If approved, the bill would allow Delawareans to collectively keep more than $30 million of the money they earn each year.

The substitute bill will be filed shortly.

Helping Economically Challenged Delaware Families

A reintroduction of House Bill 158 (151st General Assembly), this legislation will be refiled shortly by State Rep. Lyndon Yearick (R-Camden-Wyoming). It seeks to create a $500 state income tax credit for certain low-income individuals. In the case of spouses filing a joint return, the tax credit would be $1,000. Additionally, for certain qualifying low-income individuals, an existing state tax credit of $110 would be raised to $500. If a taxpayer’s obligation was less than the amount of the tax credit, the balance of the credit would be refunded in a tax return check.

“Inflation is still playing havoc with the finances of many lower-income citizens,” Rep. Yearick said. “This proposal would give these families targeted relief and a needed helping hand.”

Rep. Yearick said he was disappointed the bill did not receive a committee hearing, as it should have under House Rules during the last General Assembly session. He said he would push for fairer treatment of the bill this time out and hoped it would gain broader support. The last incarnation of the measure did not include a single Democratic lawmaker. “Every legislative district in this state contains significant working poor Delawareans who need this help,” he said.

Based on previous estimates, the bill would provide relief to vulnerable citizens, totaling about $80 million annually.

An Incentive to Hire Teenagers, Veterans, Persons with Disabilities, and former Inmates

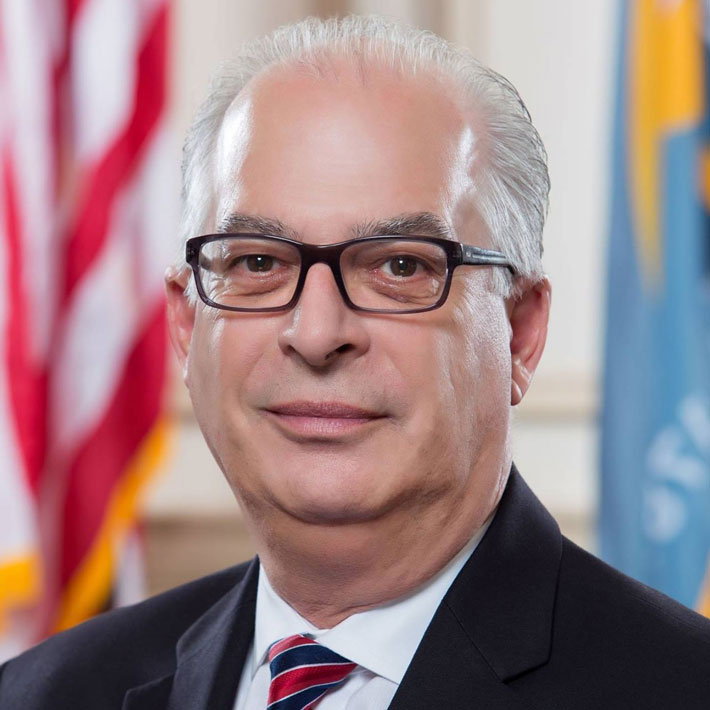

State Rep. Mike Ramone (R-Pike Creek South), a New Castle County small business owner, will soon circulate for sponsorship a bill to create an income tax credit for small businesses that employ veterans, teenagers, persons with a disability, or those entering the workforce after having been incarcerated. The two-year tax credit would apply to businesses employing 25 or fewer people and be equal to 50% of the total compensation (wages and benefits) provided to qualifying full-time employees.

“This proposal is beneficial for all,” Rep. Ramone said. “It would give people that need a break to prove themselves the opportunity to do that. It would give small business owners a chance to take a leap of faith on a job-seeker, while potentially getting a quality employee at an initially reduced cost. And it would give the state a chance to invest in a more vibrant economy and a more inclusive and diverse workforce.”

Raising the Military Income Tax Exemption

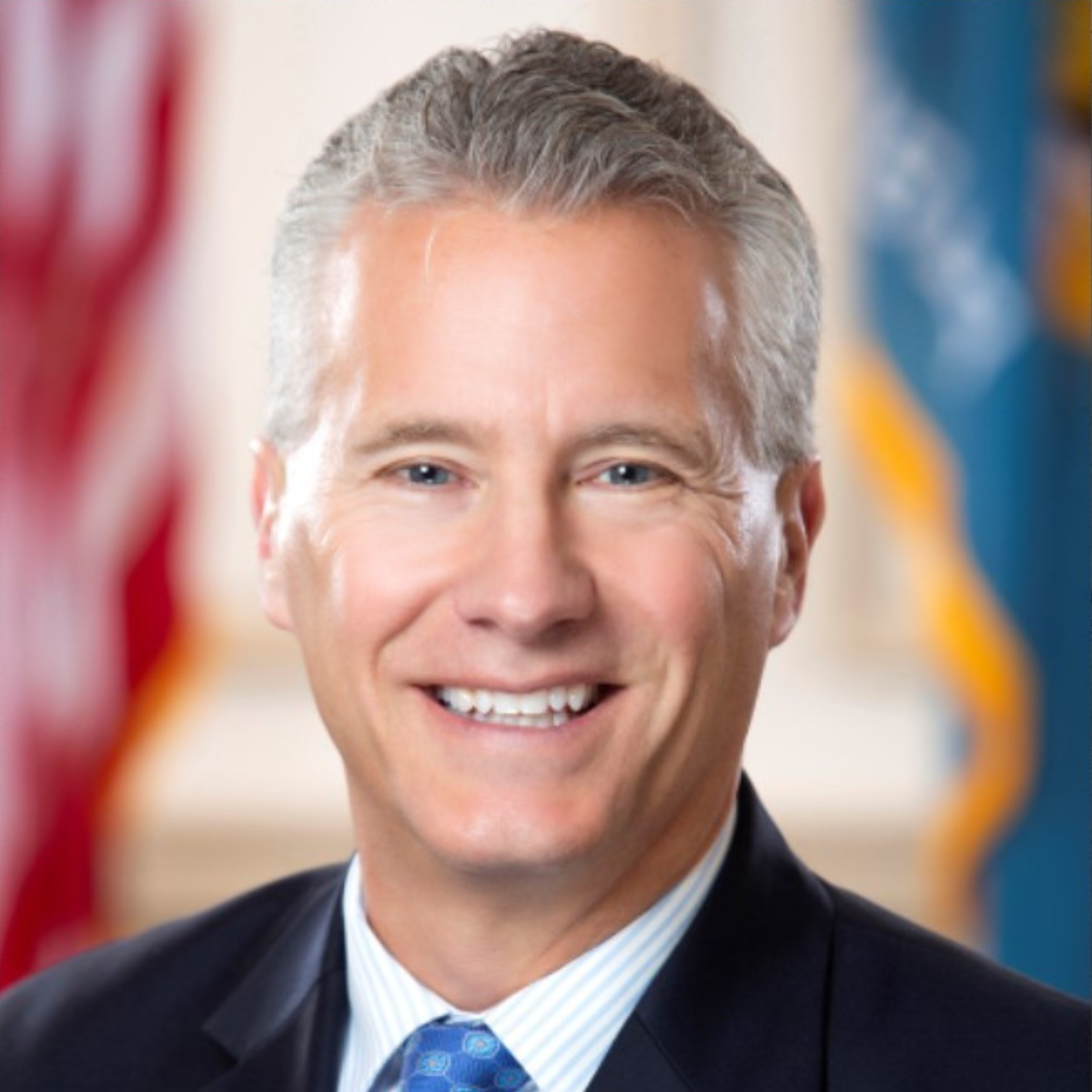

Sponsored by State Sen. Eric Buckson (R-Dover South), Senate Bill 201 would increase the amount of military pension income exempted from state income taxation from $12,500 to $25,000. The change would be phased in over three years. “Of the 41 states with income taxes, 27 fully exempt military retirement pay,” Sen. Buckson said.

“This proposal will not only make Delaware less of an outlier on this issue; it will encourage veterans to stay here or move here. Aside from it just being the right thing to do, military veterans often have unique and valuable skill sets. We need educated, disciplined people to secure our state’s future, and this proposal would help facilitate that.”

Introduced earlier this year, the bill has modest bipartisan support and awaits the consideration of the Senate Executive Committee. An estimate of the total benefit to veteran pensioners has not yet been completed.

###