Here is a link to the associated video: https://youtu.be/DncyhnX-DqU

For more information on House Bill 286, The Ericka Byler Act, use this link: https://legis.delaware.gov/BillDetail?LegislationId=140854

DOVER, DE — Under a new bipartisan bill pending action in the Delaware House of Representatives, life insurance companies would be barred from discrimination using information obtained from direct-to-consumer genetic testing companies like 23andMe and AncestryDNA.

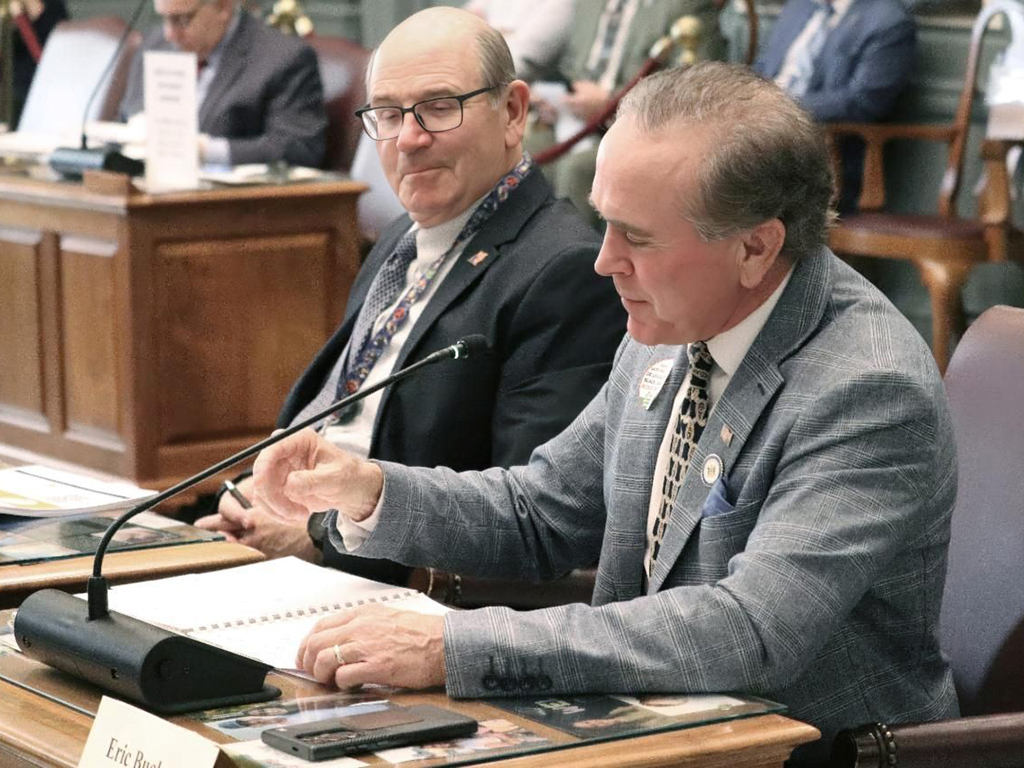

“Like many people, I’ve taken these tests,” said State Rep. Jeff Spiegelman (R-Clayton), the prime sponsor of House Bill 286. “Often, those reports contain a disclaimer stating that knowledge of what you are about to receive may affect your life insurance. I don’t think it’s fair that information you received through a test you paid for can be used by your life insurance company to boost your rates or deny you coverage.”

The bill is entitled The Ericka Byler Act, in tribute to a former Kent County native who died suddenly at the age of 25 from an undetected congenital heart defect. “That’s the other reason I think this bill is so important,” Rep. Siegelman said. “Ericka’s issue would probably not have been detected by casual genetic testing, but plenty of people have been alerted to potential health issues by these types of tests. Allowing life insurance companies to set rates, deny coverage, or terminate policies based on this private data could have a chilling effect on the appeal of submitting your DNA for analysis. I don’t want people kept in the dark about potentially serious health issues because they are worried about the financial implications of the results. This is a deterrent to wellness that we should eliminate.”

The topic is being hotly debated among lawmakers, consumer advocates, insurers, and doctors. In a letter published in a recent edition of the New England Journal of Medicine, Dr. Deborah VanDommelen voiced concerns similar to those expressed by Rep. Spiegelman, writing: “No clinician would discourage a woman from undergoing a mammogram on the basis of fears that it could affect insurability. A genetic test should be no different.”

The Delaware bill would address a gap in federal law. The Genetic Information Nondiscrimination Act (GINA) of 2008 protects Americans from discrimination by prohibiting health insurers from using genetic information to make decisions involving an individual’s eligibility, coverage, or premiums. These protections apply to private health insurers, Medicare, Medicaid, federal employees’ health benefits, and the Veterans Health Administration. However, the act does not cover long-term care insurance, life insurance, or disability insurance.

Under House Bill 286, life insurance companies could not request, require, or purchase information obtained from a direct-to-consumer genetic testing business. The measure would further prohibit using this information for canceling a policy, setting premiums, or paying claims without additional actuarial justification.

The First State is not the first to pursue this type of legislation, but it is seemingly ahead of the curve. Florida enacted a law in 2020 that is nearly identical to Delaware’s proposal. In Illinois and South Dakota, direct-to-consumer genetic testing companies cannot share an individual’s genetic test information with a life insurance company without written consent.

Twenty of Delaware’s 62 lawmakers have signed The Ericka Byler Act as sponsors or co-sponsors, including members of both parties and legislative chambers. The bill is pending the consideration of the House Economic Development/Banking/Insurance & Commerce Committee.